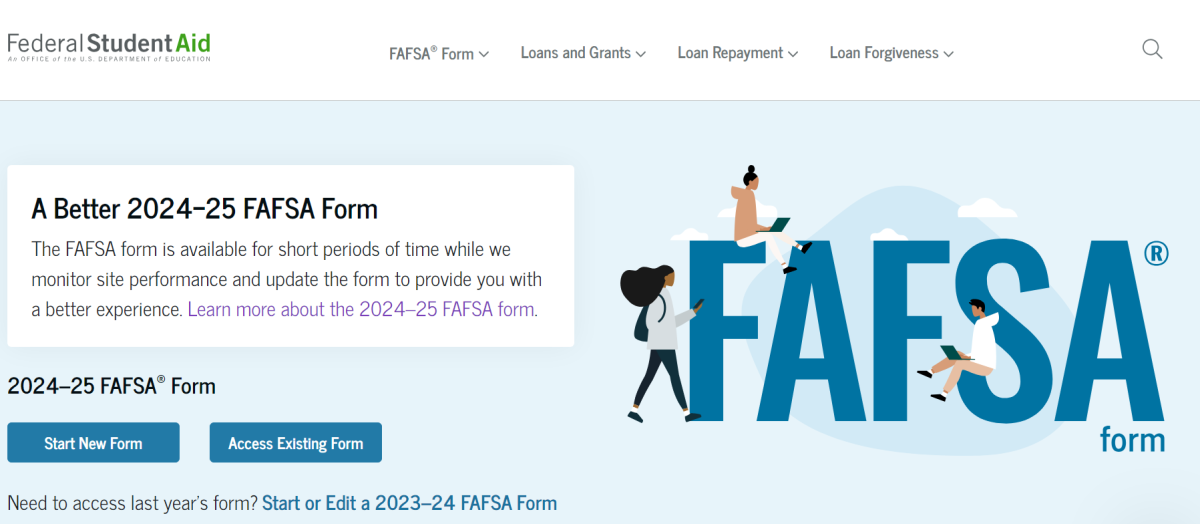

Last year, the Department of Education delayed releasing the FAFSA, a need-based federal financial aid program for students, to simplify the notoriously lengthy process of filling it out. These changes started in the 2021–22 school year, but the form is being fully overhauled this year. Typically, the program opens up on October 1st of each year, but due to all of the changes, it opened in a soft launch state on December 31, 2023.

The changes are part of the FAFSA Simplification Act, a law enacted in late 2020 to overhaul the form. According to an article from Investopedia, this was the biggest change to Title IV of the Higher Education Act of 1965 in over 50 years. This will streamline the process of applying from over 100 questions to approximately 36. The changes have been rolled out slowly since the bill’s passage. Starting in 2021–22, eligibility was changed to allow students to apply regardless of drug convictions and Selective Service registration. In addition, now students can apply for the Pell Grant regardless of their incarceration status.

This year, students nationwide are predicted to gain billions in funding. However, students with siblings in college may get less funding than before. According to nonpartisan EconoFact, students with family income between $60,000 and $100,000 could see reduced grants from the Pell Grant, a federal grant associated with the FAFSA. This is due to the formula that the government uses to determine financial aid eligibility changing from the Expected Family Contribution (EFC) to a new Student Aid Index (SAI), which, unlike the prior formula, does not provide special treatment to families with multiple members in college.

In addition to the prior change, the SAI will not take into account state and local taxes; it also allows a minimum of -1500 for the index, which indicates students in higher need than the EFC previously allowed. Students with lower SAI scores will receive more financial aid from the FAFSA as well as increased eligibility for the Pell Grant. The index will be equal to your parent’s available income, your income, as well as your assets.

According to USAToday, these changes will result in less eligibility for middle- to upper-class families but increased funding for low-income families. This especially applies to the Pell Grant, which will grant more money the further a family is below the federal poverty level. It is projected that approximately 2.1 million more students who were previously ineligible for the grant may become eligible this year.

Another change to the FAFSA is the inclusion of tax and income data directly from the IRS, rather than students and their families reporting that information themselves. Colleges are also required to disclose additional information about the cost of attendance, including things like the cost of course materials, transportation, rooming, loan fees, and living expenses, which gives more potential for additional financial aid. However, parents still need to create an FSA account, as do applicants, as both are required to fill out the simplified form. These changes allow for financial aid applications to be much easier for students, along with more support being given to low-income families who need the aid the most.

In addition, the application has a tool for students and their families to estimate the amount of financial aid they will receive from the government.